How can Indian bloggers deposit their US dollar cheque or foreign currency checks in Indian bank accounts? You cannot simply fill a cheque deposit slip and drop your US dollar cheque or any other foreign currency into the bank ATM dropbox, unlike an Indian rupee cheque.

Over the years, so many Indian bloggers have asked me this as they excitedly receive their first US dollar or euros cheque and want to find how to deposit it without hassles.

Google Adsense dollar earnings come pre-converted in Indian rupees and can be simply dropped into ATMs to your bank account number scribbled behind the cheque (though an automatic bank NEFT transfer is a better way to do this now).

But your other affiliate income from Amazon sales, ShareaSale, BuySellAds, etc are sent to your mailing address as dollar cheques and a mailed cheque in India need to properly deposited if you want to claim foreign currency earnings.

Deposit US Dollar or Foreign Currency Cheque

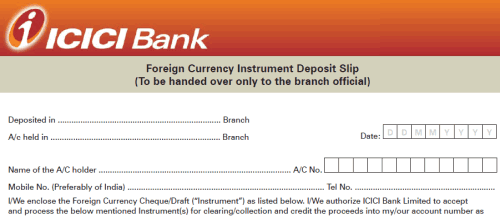

So you need to visit your bank and the foreign currency check needs to be submitted to the NRI desk of your bank. An appropriate foreign currency deposit form (also called Indemnity Letter Cum Deposit Slip or foreign currency instrument deposit slip) needs to be attached to the cheque and all details regarding this overseas income need to be filled.

It seems RBI makes it mandatory that Indian banks accept foreign exchange cheques through this route only.

Where to get a foreign currency deposit slip?

Most top banks now have international operations and foreign currency exchange desks. They have made it easier to accept foreign currency in your bank accounts and most of them have the currency deposit slip available online.

For example, if you have an ICICI bank account, you will need to submit this signed ‘Indemnity Letter cum deposit slip‘ to the nearest bank branch. More details from the bank are available online. Search online to find the deposit form for your own bank.

Do check with your bank how much foreign currency you can deposit. For higher amounts, there might be some foreign exchange rules as per Indian law. It also seems most banks will accept common international foreign currencies like US Dollar (USD), CAD, GBP, EUR, CHF, SGD, AUD, NZD, AED, HKD, JPY, and ZAR. Remember to safely keep a photocopy of the cheque, the deposited form, and also the receipt returned by the bank officer.

Currency Purpose Code

A very important field to fill besides the cheque details is the purpose of remittance (remember earlier how important purpose code is for Paypal India users).

Typically freelancers or bloggers using advertising services like Google Adsense might have to choose purpose code as advertising (located in Other Business Services).

Foreign Currency Credit Time

Typically it takes a few weeks to credit the money to your bank account and most banks will say 21 international working days.

Foreign Currency Deposit Charges

They will deduct a small percentage as processing charges and your final Indian rupee conversion rate may vary depending on the US dollar-rupee conversion rate on the day the cheque is actually processed.

Our bank charges 0.25% subject to a minimum of Rs.250, but it can vary with different banks and depends also if you have an Individual or NRI bank account.

So this how you can deposit your dollar income to your Indian bank account – Happy earnings!